Closed End Credit Account

Closed end credit account Closed accounts stay on your report for different amounts of time depending on whether they had positive or negative history. A temporary account, as mentioned above, is an account that needs to be closed at the end of an accounting period. When you make your final payment, the loan is closed. Provided you make the payments as required, the loan terms generally do not change. Self visa® credit card eligibility The credit is obtained for a particular purpose, and the borrower is required to pay the entire loan, including the interest and maintenance fees, at the end of the. For residential mortgages and extensions of credit secured by the member’s dwelling, the disclosures must be provided within. Understanding your credit score ; The accountant then needs to make a debit of $5,000 from the drawings account and a credit of the same amount to the capital account. Accounts with adverse information may stay on your credit report for up to.

In This Article We Will Discuss The Differences Between Closed End And Open End Credit How They Work And What You Need To Know Credits Closed Open

Unsecured credit limit increases ; Scra for military members ; Closing a bank account is not complicated, but there are specific actions everyone should take so the account is closed correctly and all of your money is accounted for prior to closure. Is a sort of credit that must be paid back in full by the end of the term, on a specific day. Your self visa® credit card is lost or stolen ; Also, the loan terms cannot be modified.

Closed end credit account. This generally helps your credit score. For purposes of this policy, retail credit also includes loans to individuals secured by their personal residence, including first mortgage, home equity, and home improvement loans. What is true about closed end credit? Canceling or closing your account ; Self visa® credit card basics ; If you need to borrow money again, you must apply for another loan. You can contact hmrc’s helplines (0345 300 3900 for tax credits or 0300 200 3100 for child benefit) or use your personal tax account to provide alternative account details. Scheduling credit builder account payments ; If you close an account you never use with a $8,000 credit limit, your debt utilization is going to go from 30% ($6,000 out of $20,000) to. Credit cards, home equity loans, personal lines of credit, and bank account overdraft protection are all examples. For example, the drawings account contains $5,000.

Are Car Loans Open Or Closed Car Loans Car Loan Calculator Loan

Does Everyone Get Approved For Student Loans Student Loans Student Loan Application Federal Student Loans

Closed-end Credit Vs An Open Line Of Credit Whats The Difference Line Of Credit Personal Line Of Credit The Borrowers

Cefconnectcom Closed-end Funds Investment Personal Finance Investing Fund

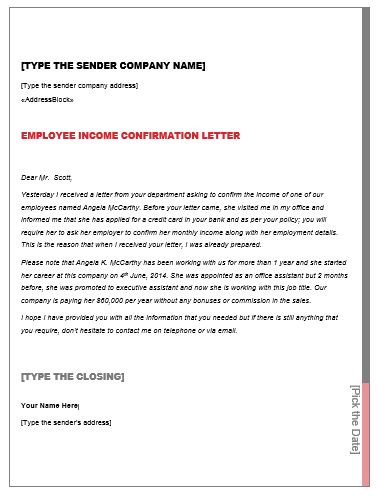

Income Confirmation Letter Confirmation Letter Support Letter Lettering

Credit Card Dorks Cc Ccv Db Carding Dorks List 2017 Howtechhack Computer Data Computing In 2021 Doctors Note Template Amazon Card Credit Card Info

16 Server Bartender Resume Resume Skills Server Resume Resume Examples

Standby Letter Of Credit By Universal Trading Company Ltd Financial Instrument Lettering Financial Services

0 Response to "Closed End Credit Account"

Post a Comment